Personal Trust Administration

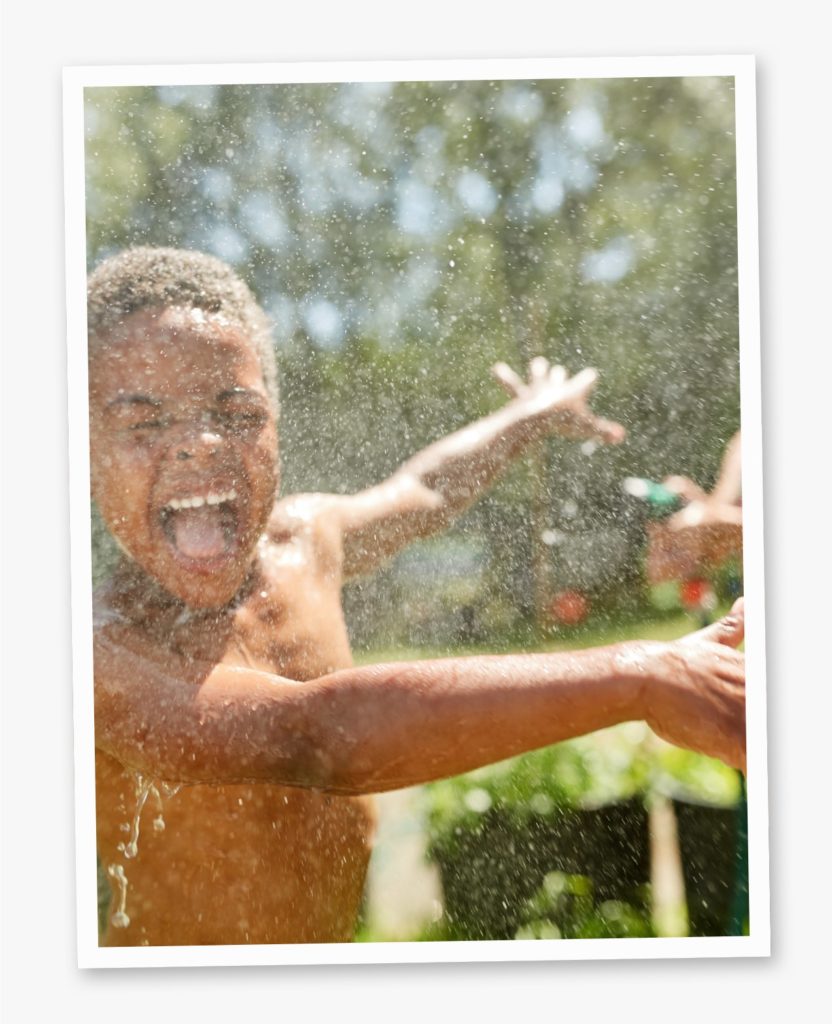

Preserve What’s Important

Establishing a trust is not merely a plan to minimize taxes. Instead, a trust helps to ensure your assets—the ones that you’ve worked so hard to build—are distributed in the time frame and manner you desire. Creating a trust can protect your assets and make sure those assets are managed for the benefit of your children or loved ones.

Cumberland Trust acts as a truly independent trust company.

- We are not investment advisors and focus our efforts solely on trust and estate administration.

- We are located in one of the most trust-friendly states, giving our clients and their assets access to very favorable trust laws.

- We are compassionate and diplomatic when dealing with complex family relationships.

- Our relationship managers provide a high level of communication and responsiveness for the clients we serve.

- We provide continuity to ensure that beneficiaries have a reliable trustee and someone to turn to throughout the duration of the trust

Types of Personal Trusts

- Revocable living trusts

- Marital and credit shelter trusts

- Irrevocable grantor trusts

- Asset protection trusts

- Community property trust

- Family foundations and charitable trusts

- Irrevocable life insurance trusts

- Grantor-retained annuity trusts (GRATs)

- Qualified personal residence trusts (QPRTs)

- Generation skipping and dynasty trusts

- Qualified domestic trusts (QDOTs)

The Tennessee Trust Advantage

Tennessee has long been a friendly state to trusts, thanks to its favorable tax laws and its adoption of a handful of important asset protection legislation:

The Prudent Investor Act, passed in 2002, encourages the use of modern portfolio theory in managing trust assets and defines how trust investment management may be delegated to an investment manager.

The Uniform Trust Code, passed in 2004, provides a comprehensive set of laws that allow a trust to be administered very efficiently and effectively. Many matters that used to require a court to resolve may now be resolved by agreement among the beneficiaries.

The Tennessee Investment Services Act, passed in 2007, allows the creator of a trust to place assets in a Tennessee Investment Services Trust, also known as a self-settled or asset protection trust, to protect them from future lawsuits, creditors, and other predators. The Tennessee asset protection trust is available to anyone in the country as long as a qualified trustee is a resident of Tennessee or a Tennessee-based trust institution.

The Tennessee Community Property Trust Act, passed in 2010, creates benefits for trusts owned by spouses, including providing equal ownership of property and the sharing of appreciation and income. It also reduces capital gains tax implications after the death of one spouse. As with the TISA, this act requires that the trustee is a Tennessee resident or trust company.

Multi-Participant Trust legislation was enacted in 2013 that encourages the use of trust advisors and trust protectors to assist in the management of a trust. This legislation allows all of the trust creator’s top advisors to be involved in the trust management.

What are the potential benefits and protections offered by a trust?

Trusts offer an excellent way to plan for the future. While they’re a valuable component of estate planning, trusts offer more than simply a way to disburse assets upon death or minimize paying taxes.

- Provide for the management of assets while a person is still living and govern how assets will be distributed upon death.

- Provide a measure of protection when beneficiaries may lack the maturity or expertise to manage their own affairs.

- Help beneficiaries avoid the unnecessary expenses of probate.

- Provide regular disbursements to someone who is unable to manage large sums of money.

- Provide income for the trust creator during their lifetime with the remainder left to a charity or institution.

- Protect assets from future lawsuits, creditors, or divorce.

- Ensure that government assistance continues while the basic level of care is supplemented for a child with special needs.

- Provide for the management of an individual’s assets should he or she become incapacitated.

- Ensure that assets such as a family business are left undivided.

- Ensure that estate taxes are minimized as much as possible.

Meet Our Personal Trust Administration Team

Christopher D. Buckley

Chief Fiduciary Officer

Caroline L. H. Bradshaw

Senior Vice President & Managing Director, Trust Administration

Mary Elizabeth Carothers

Trust Officer

Shelby Carpenter

Vice President & Trust Officer

Tenisha Clausi

Vice President & Trust Officer

Emily Dye

Trust Officer

Danielle Frye

Trust Administrator

Alex Gillott

Senior Vice President & Managing Director, Trust Administration

Laura Hawken

Assistant Vice President & Trust Officer

Andrea Higgins

Assistant Vice President & Trust Officer

Jody Hines

Vice President & Trust Officer

Philip Katsadouros

Trust Specialist

Madison Kroeber

Trust Administrator

Amanda Laginess

Assistant Vice President & Trust Officer

Sarah Leighton

Trust Administrator

Owen Lovell

Trust Administrator

Jared Lynd

Vice President & Trust Officer, Administration Manager

Ginny Maddux

Trust Officer

Katrina Martin

Assistant Vice President & Trust Officer

Camille McRae

Trust Specialist

Hadley Pagel

Trust Specialist

Bonnie Parrish

Trust Officer

Lindsay Phillips

Trust Administrator

Samuel Raymond

Trust Officer

Brian Rees

Trust Officer

Jennie Renwick

Vice President & Trust Officer

Ryan Russell

Assistant Vice President & Trust Officer

Greg Sauers

Trust Officer

Dudley Selinger

Vice President & Trust Officer, Administration Manager

Tessa Shackelford

Trust Specialist

Sloan Shell

Vice President & Trust Officer, Administration Manager

Lauren Skipp

Assistant Vice President & Trust Officer

Sara Speidel

Vice President & Trust Officer

Taylor Stogner

Trust Officer

Taylor Suggs

Trust Specialist

Kathryn Thomas

Trust Specialist

Taylor Vars

Trust Specialist

Alex Walker

Assistant Vice President & Trust Officer

Lou Anne Wolfson

Vice President & Trust Officer, Administration Manager

Conveniently Headquartered in Trust-Friendly Tennessee

With a connected team of 140+ experts at your service in 11 offices nationwide.

Resources and Insights

How to Help Your Client Select the Best Charitable Giving Structure

Philanthropic giving is a common goal for many individuals. The choice to give is often fueled by the

Stay Relevant with the Next Generation: Trust Beneficiaries

As generational wealth transitions from founders to heirs, family offices face a pivotal challenge: remaining relevant and resonant

How Cumberland Trust Partners with Family Offices

Many corporate trustees follow a rigid, one-size-fits-all approach that may not align with family offices’ personalized, high-touch service.